Impax Reports Stronger Positive Environmental Impact in 2021

Impax Asset Management is a U.K.-based global stock investment manager making a worldwide difference for the environment. In 2016, Portico made a $20 million social impact first (SIF) investment in an Impax environment-focused strategy. Annually, Impax reports on the positive environmental impact created by Portico’s Impax portfolio, and Portico passes this information on to its members.

“The impact information provided by Impax is part of the return on investment for Portico members who, in 2021, were invested in the Portico Social Purpose Target Date Funds (TDFs), Portico Global Stock Social Purpose Fund, or the Portico Non-U.S. Social Purpose Fund” said Erin Ripperger, Portico’s manager of socially responsible investing and investor advocacy. “This information allows them to celebrate the many ways their investment had positive impact on the environment.”

Impax targets companies expected to flourish as the global economy transitions to a more sustainable model — and reduces or eliminates exposure to companies likely to lose from that transition. Specifically, it invests in companies pursuing positive environmental strategies with measurable outcomes, including wind farms, solar technology, and wastewater-reduction and -treatment techniques.

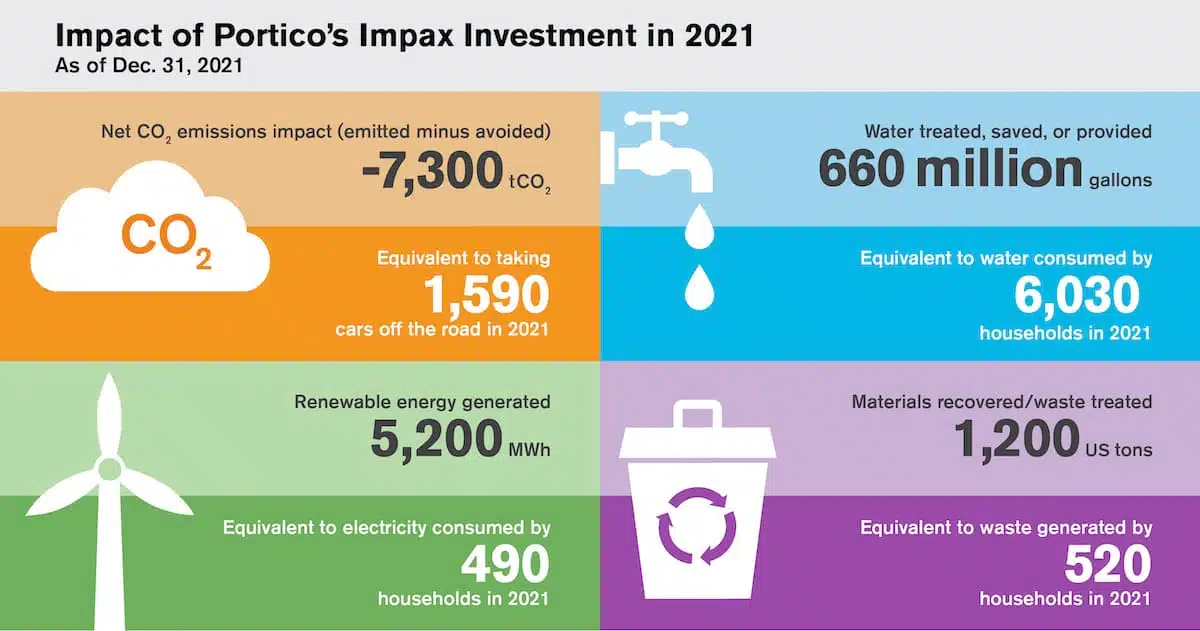

Measurable Impact in 2021

After lower-than-usual impact reported for 2020, the first year of the pandemic, Impax reported significantly stronger results for 2021. “We’re thrilled to see impact numbers strengthen,” said Ripperger, “across all four of our impact measures — net CO2 emissions avoided; renewable energy generated; water treated, saved, or provided; and waste materials recovered or recycled.”

Worth noting: Impact data is always subject to what portfolio companies can provide. While measurement and disclosure are improving, impact measurement is an evolving discipline. For this reason, Impax strives to strengthen the breadth and depth of impact reporting over time — through proprietary research and by encouraging the companies it invests in to improve their disclosure on sustainability metrics.

What is Social Impact First (SIF) Investing?

To help achieve measurable social impact, 14 of Portico’s 15 social purpose funds employ a form of positive social investing called social impact first (SIF) on up to 10% of fund assets (excluding the Portico Stock Index Social Purpose Fund). SIF investments accept a somewhat lower projected return and/or somewhat higher projected risk on up to 10% of the fund’s investments in order to invest in companies and organizations that support initiatives like affordable housing, reduced greenhouse emissions, and renewable energy — priorities that align with ELCA social teachings and policies.

“It’s been a Portico objective since 2015 to carefully and steadily increase the number of SIF investments made through our social purpose funds,” Ripperger said. “In 2021, we successfully achieved a balanced portfolio of SIF investments that comes close to the maximum allowed in the social purpose funds. We make these investments with the intent to create solid financial returns for member investors and positive social outcomes important to member investors and the ELCA.”

For more information about all funds managed by Portico Benefit Services, please see the Investment Fund Descriptions.

Information regarding Portico funds should not be considered as advice or as a recommendation to hold, purchase, or sell those financial products and does not take into account your particular investment objectives, financial situation, or needs. For more information about all funds managed by Portico Benefit Services, please see the Investment Fund Descriptions for your retirement plan on the Fund Performance page of myPortico and speak with your tax, legal, or financial professional.

Members should carefully consider the target asset allocations, investment objectives, risks, charges, and expenses of any fund before investing in it. All funds, including the Portico funds, are subject to risk and uncertainty. Past performance is no guarantee of future performance. Funds managed by Portico Benefit Services, including the Portico funds and ELCA Participating Annuity Investment Fund, are not insured or guaranteed by the Federal Deposit Insurance Corporation, any other government agency, or the ELCA. Fund assets are invested in multiple sectors of the market. Sectors, like funds, may perform below expectations and lose money over short or extended periods. Review the Portico Investment Fund Descriptions and the Investment Memorandum for the ELCA Participating Annuity Trust for more information about the Portico funds.

Target date funds are designed for members expecting to retire around the year indicated in each fund’s name. When choosing a fund, members should consider whether they anticipate retiring significantly earlier or later than age 65, and select the target date fund that aligns with their expected retirement age. There are many considerations relevant to fund selection; members should choose the fund that best meets their individual circumstances and investment goals. Each fund’s asset allocation strategy becomes increasingly more conservative as it approaches the target date and beyond. Each fund’s investment risk changes over time as its asset allocation changes. The investment process used by the investment managers and the target asset allocation of the funds may change at any time, without notice.

Neither Portico Benefit Services nor the funds it manages are subject to registration, regulation, or reporting under the Investment Company Act of 1940, the Securities Act of 1933, the Securities Exchange Act of 1934, the Investment Advisors Act of 1940, or state securities laws. Members, therefore, will not be afforded the protections of those laws and related regulations.